Exness Trading Account Types

Exness offers a range of trading account types tailored to meet the needs of different traders, from beginners to advanced professionals. Each account type provides unique features, trading conditions, and flexibility to suit various trading styles and objectives.

What are Exness Accounts?

Exness Accounts are trading accounts offered by Exness, each tailored to meet the specific needs of different types of traders. They provide access to a wide range of financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies, allowing traders to choose the account type that best fits their trading goals, experience level, and strategies.

Exness Standard Accounts

Exness offers two types of Standard Accounts that cater to a wide range of traders, particularly those new to trading or looking for low-cost, flexible options. Both account types come with competitive trading conditions, making them popular choices for beginners and intermediate traders.

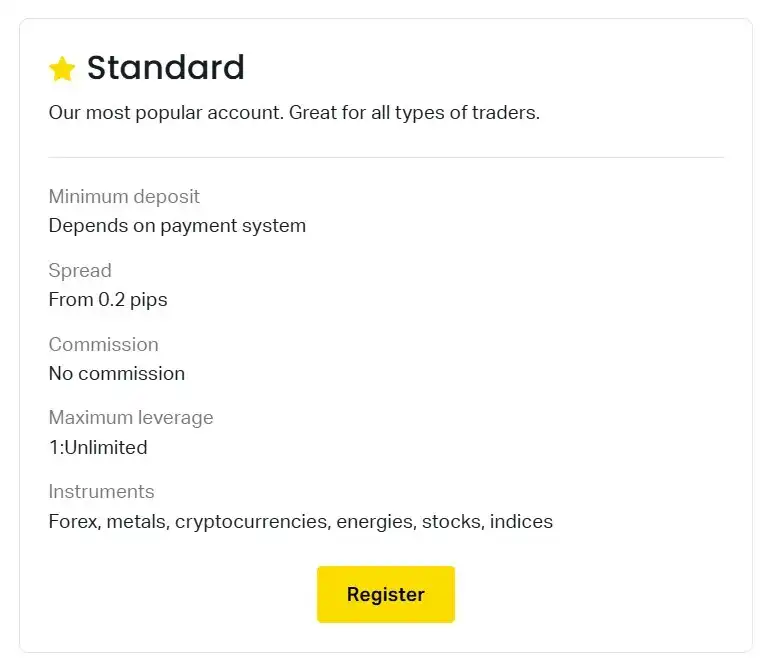

Standard Account

The Exness Standard Account is designed for both beginner and intermediate traders who are looking for a simple, cost-effective trading environment with flexible options. It combines low minimum deposits with zero commission fees, making it an ideal choice for traders who want straightforward access to global markets.

Key Features of the Standard Account

- Low Minimum Deposit: Start trading with a minimal initial investment, making this account highly accessible for traders at all levels.

- No Commission Fees: The Standard Account is commission-free, which means you only pay for the spread, keeping trading costs transparent and manageable.

- Competitive Spreads: Spreads start from as low as 0.3 pips, allowing for affordable trading on major forex pairs, commodities, stocks, and cryptocurrencies.

- Flexible Leverage: Choose leverage settings that suit your trading style and risk tolerance, giving you the flexibility to trade with increased market exposure.

- Wide Range of Instruments: Access a diverse set of trading instruments across forex, indices, stocks, cryptocurrencies, and commodities, giving you plenty of options to diversify your portfolio.

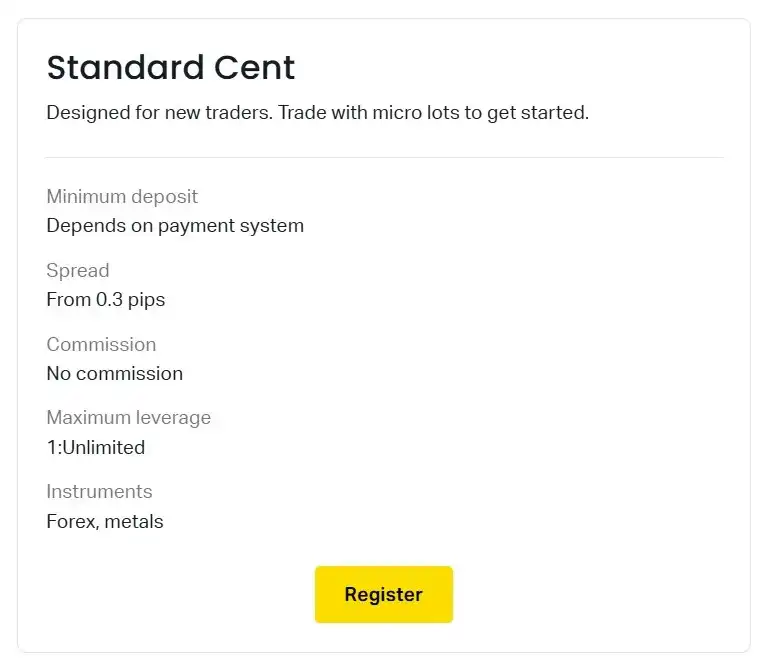

Standard Cent Account

The Exness Standard Cent Account is specifically designed for beginners and traders who want to practice in a live environment with minimal financial risk. Trades in this account are conducted in cent lots, making it an ideal choice for those testing strategies, learning market mechanics, or simply trading with smaller amounts.

Key Features of the Standard Cent Account

- Cent Lots: All trades are executed in cent lots, where 1 standard lot equals 100 cents, allowing traders to trade smaller volumes and manage risk more effectively.

- Minimal Financial Commitment: This account requires only a small deposit, making it accessible and ideal for practicing in live market conditions without a significant financial investment.

- No Commission Fees: Like the Standard Account, the Standard Cent Account is commission-free, with costs limited to spreads.

- Spreads from 0.3 Pips: Competitive spreads starting from 0.3 pips, providing cost-effective access to various assets even at smaller trade sizes.

- Wide Range of Instruments: Although trades are in cent lots, you still have access to a variety of instruments, including forex, metals, and cryptocurrencies.

Exness Professional Accounts

Exness offers a suite of Professional Accounts designed for experienced traders who seek advanced trading conditions, tighter spreads, and efficient execution. These accounts provide enhanced features tailored to support high-frequency trading, scalping, and other advanced strategies. Exness Professional Accounts include the Pro Account, Raw Spread Account, and Zero Account.

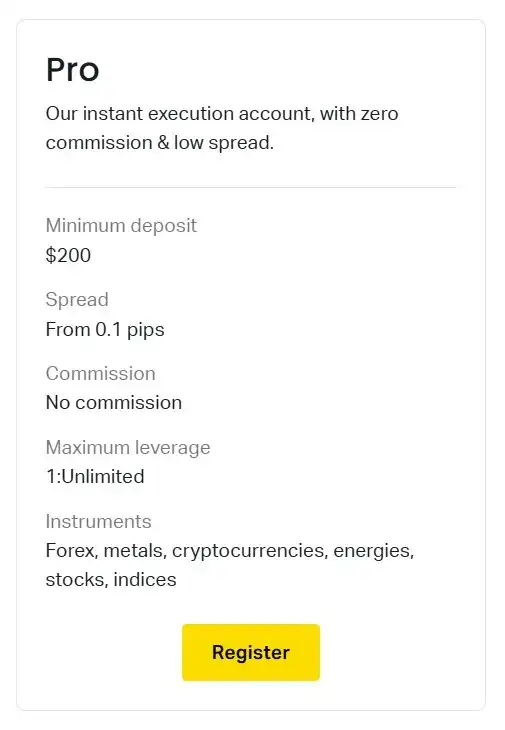

Exness Pro Account

The Exness Pro Account is designed for experienced traders who seek advanced trading conditions without additional commission fees. With competitive raw spreads, fast execution, and flexible leverage, the Pro Account offers a high-performance environment suited to a wide range of trading strategies, including scalping, day trading, and swing trading.

Key Features of the Exness Pro Account

- Raw Spreads from 0.1 Pips: Enjoy competitive raw spreads that start as low as 0.1 pips on major forex pairs. This low spread structure helps reduce trading costs, allowing for better cost efficiency.

- Zero Commission: Unlike many professional accounts, the Pro Account charges no additional commission fees, so traders only pay for the spread. This is particularly beneficial for high-frequency and high-volume traders looking to minimize costs.

- Flexible Leverage Options: Choose from a range of leverage settings based on your risk tolerance and trading strategy. This flexibility allows traders to adjust their market exposure according to their preferences and market conditions.

- Instant Execution: The Pro Account offers fast and reliable order execution speeds, ensuring that trades are executed at the desired price with minimal slippage. This is especially advantageous for strategies that rely on timely market entries and exits.

- Access to a Broad Range of Instruments: Trade across multiple asset classes, including forex, indices, stocks, cryptocurrencies, and commodities, providing opportunities for diversification and exposure to global markets.

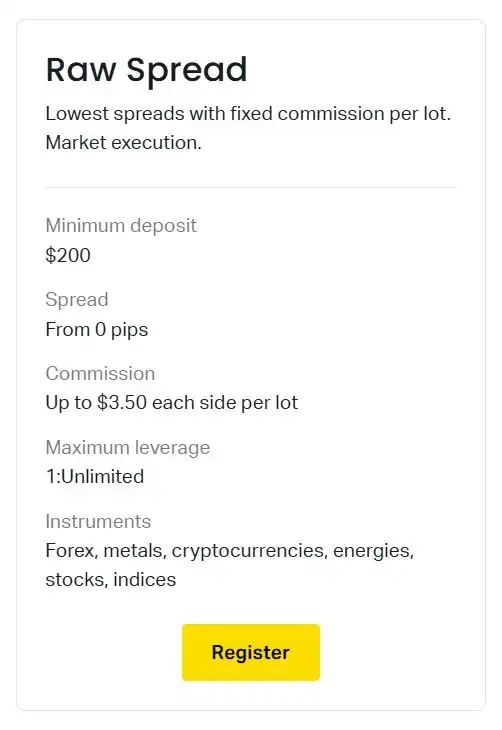

Raw Spread Account

The Exness Raw Spread Account is tailored for traders who prioritize the lowest possible spreads, making it an excellent choice for scalpers, day traders, and high-frequency traders who need precise entry and exit points. With spreads starting from 0.0 pips on major instruments and a small commission per trade, this account type provides highly competitive conditions designed for cost-sensitive strategies.

Key Features of the Exness Raw Spread Account

- Ultra-Low Spreads from 0.0 Pips: Spreads start from 0.0 pips on major forex pairs, providing minimal cost per trade and enabling traders to capture more precise price movements.

- Low Commission per Lot: A small, fixed commission fee is charged per lot traded, which helps maintain transparency and predictability in trading costs.

- Fast Order Execution: The Raw Spread Account is optimized for quick and reliable order execution, which is essential for high-frequency trading strategies where timing is crucial.

- Flexible Leverage Options: Choose from adjustable leverage levels based on your trading strategy and risk tolerance, allowing for greater control over market exposure.

- Wide Range of Instruments: Trade a variety of assets, including forex pairs, indices, stocks, commodities, and cryptocurrencies, offering extensive opportunities for diversification.

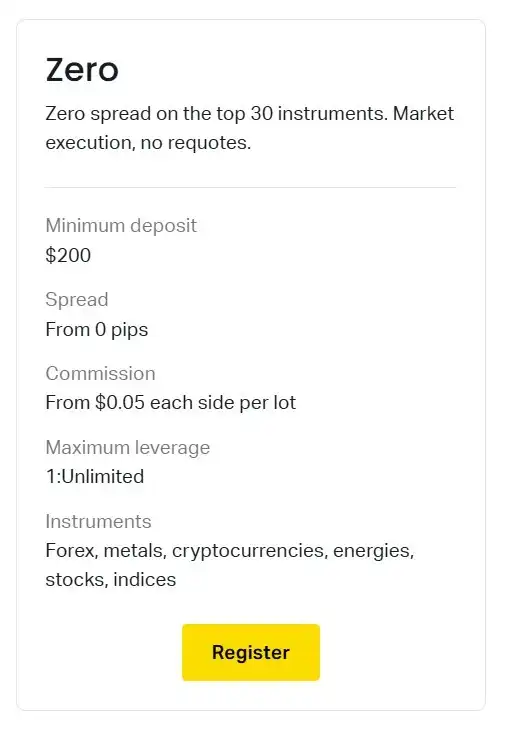

Exness Zero Account

The Exness Zero Account is designed for traders who prioritize zero spreads on major instruments and require precise cost management. This account type offers spreads as low as 0.0 pips on key trading instruments, along with a fixed commission per trade, making it a great choice for scalpers, day traders, and high-frequency traders who need transparent, predictable costs.

Key Features of the Exness Zero Account

- Zero Spreads on Major Instruments: Enjoy spreads starting from 0.0 pips on popular instruments, including major forex pairs. This feature allows traders to open and close positions without incurring spread costs, making it ideal for cost-sensitive strategies.

- Fixed Commission per Lot: The Zero Account has a fixed, competitive commission per lot traded, providing a clear cost structure that simplifies budgeting and cost management.

- High-Speed Execution: The Zero Account offers fast and reliable order execution, which is essential for strategies that rely on quick market entries and exits.

- Flexible Leverage Options: Choose from customizable leverage settings to match your trading strategy and risk tolerance, giving you control over market exposure.

- Broad Range of Instruments: Access multiple asset classes, including forex, indices, stocks, commodities, and cryptocurrencies, allowing for a diversified approach to trading.

Exness Islamic (Swap-Free) Accounts

Exness Islamic Accounts, also known as Swap-Free Accounts, are tailored for traders who adhere to Sharia law, which prohibits earning or paying interest. These accounts provide all the standard trading features of Exness accounts but with no swap or rollover interest on overnight positions, making them fully compliant with Islamic principles.

Key Features of Exness Islamic Accounts

- No Swap or Interest Charges: Islamic Accounts do not incur swap fees on positions held overnight, ensuring that no interest is charged or credited on trades.

- Available Across Multiple Account Types: The swap-free feature is available for both Standard and Professional accounts, including the Standard, Standard Cent, Pro, Raw Spread, and Zero accounts. This gives traders the flexibility to choose the account type that best suits their strategy while remaining Sharia-compliant.

- Same Spreads and Commissions: Exness Islamic Accounts offer the same competitive spreads and commission structures as their standard counterparts, ensuring traders do not face any additional costs for choosing a swap-free option.

- Access to a Wide Range of Instruments: Islamic Accounts provide access to a full range of trading instruments, including forex, metals, indices, stocks, and cryptocurrencies, allowing for diverse portfolio management without the burden of swap fees.

- Flexible Leverage Options: Enjoy high leverage levels based on your chosen account type, allowing for a tailored approach to risk management.

Exness Demo Account

The Exness Demo Account is a valuable tool for both new and experienced traders, allowing them to practice trading in a simulated environment with virtual funds. With real-time market conditions and full access to Exness’ trading platforms, the demo account offers a risk-free way to develop trading skills, test strategies, and familiarize yourself with the platform.

Key Features of the Exness Demo Account

- Risk-Free Trading: Practice with virtual funds in a simulated environment, so there is no risk of losing real money. This feature is especially beneficial for beginners looking to understand market dynamics without financial exposure.

- Real-Time Market Data: The demo account mirrors live market conditions, including price fluctuations, spreads, and order execution, providing a realistic trading experience.

- Full Access to Trading Platforms: Trade on Exness’ MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, with access to all platform features, including technical indicators, charting tools, and timeframes.

- Multiple Instrument Access: The demo account provides access to a broad range of instruments, including forex, stocks, commodities, indices, and cryptocurrencies, allowing you to explore different markets and diversify your practice trades.

- Flexible Virtual Balance: You can set your virtual balance to simulate the amount of capital you plan to trade with in a live account, helping you practice realistic risk management.

How to Choose and Open an Exness Account

Selecting the right Exness account depends on your trading experience, strategy, and financial goals. Here’s a guide on choosing the best account type for your needs and the steps to open it.

Step 1: Choosing the Right Exness Account

Exness offers several account types, each designed for different levels of experience and trading styles:

- Standard Account: Ideal for beginners, this account features low minimum deposits, no commission fees, and competitive spreads. It’s suitable for traders looking to start with minimal financial commitment.

- Standard Cent Account: Designed for those who want to trade in smaller lot sizes, this account is perfect for new traders and strategy testing. Trades are conducted in cent lots, minimizing financial risk.

- Pro Account: Suitable for experienced traders, the Pro Account offers raw spreads, no commission fees, and fast execution speeds, making it ideal for high-volume and short-term trading strategies.

- Raw Spread Account: For traders who prioritize ultra-low spreads, this account offers spreads starting from 0.0 pips on major instruments, with a small fixed commission per lot. It’s a top choice for scalpers and high-frequency traders.

- Zero Account: This account provides zero spreads on major instruments with a fixed commission per lot. It’s suitable for traders who want precise pricing and transparent costs, making it ideal for high-volume strategies.

- Islamic (Swap-Free) Account: Available as a swap-free option across most account types, the Islamic Account is suitable for traders who adhere to Sharia law, as it incurs no swap fees on overnight positions.

Step 2: Opening an Exness Account

Once you’ve chosen the account type that best suits your trading style, follow these steps to open your Exness account:

- Sign Up on the Exness Website:

- Go to the Exness homepage and click Open Account.

- Enter your email, country of residence, and set a secure password.

- Select Your Preferred Account Type:

- In your Personal Area, you’ll see options to create a Standard or Professional account. Choose the account type that matches your selected option.

- Complete Personal Information:

- Provide the required personal information, such as your full name and contact details, for account security and verification purposes.

- Verify Your Identity and Residence:

- Upload a valid government-issued ID (e.g., passport or driver’s license) to verify your identity.

- Provide proof of residence (e.g., utility bill or bank statement) to verify your address.

- Set Your Trading Preferences:

- Customize your account with leverage settings, preferred base currency, and any additional preferences.

- Deposit Funds:

- Fund your account using your preferred payment method, including bank transfers, credit/debit cards, or e-wallets. Minimum deposit requirements vary by account type.

- Download the Trading Platform:

- Select the trading platform (MT4 or MT5) and download the desktop or mobile app for full access to trading tools.

Account Features Comparison

Exness offers a variety of account types, each designed to meet the needs of different trading strategies and experience levels. Here’s a comparison of key features across Exness account types, including Standard, Standard Cent, Pro, Raw Spread, and Zero accounts.

Minimum Deposits Vary by Account Type

- Standard Accounts: Start with low minimum deposits, making them accessible for beginners.

- Professional Accounts: Require higher deposits for advanced features, supporting more experienced traders.

Spreads Differ Across Accounts

- Standard Accounts: Competitive spreads starting from 0.3 pips.

- Raw Spread and Zero Accounts: Tighter spreads, from 0.0 pips, with small commission fees.

Leverage Options Match Trading Styles

- Exness provides flexible leverage for each account type, allowing traders to adjust leverage according to their risk tolerance and trading style.

Commission Structures Support Various Strategies

- Standard Accounts: No commission fees, suited for beginners and lower-volume trading.

- Professional Accounts: Raw Spread and Zero Accounts include low commission fees, ideal for cost-sensitive strategies.

Frequently Asked Questions

How to Switch Between Exness Account Types?

Switching between Exness account types is easy. Log in to your Exness Personal Area, where you can create a new account of your preferred type (e.g., Standard, Pro, Raw Spread) without needing to close your existing account. This allows you to maintain multiple accounts and select the one that best matches your trading strategy at any time.

Which Exness Account Suits Beginner Traders?

The Standard Account and Standard Cent Account are ideal for beginner traders. These accounts have low minimum deposit requirements, no commission fees, and competitive spreads. The Standard Cent Account is particularly suitable for new traders who want to start with smaller trade sizes, as it uses cent lots, allowing for risk management while gaining experience in real-market conditions.

When to Upgrade Trading Account?

Consider upgrading to a Professional Account, such as the Pro, Raw Spread, or Zero Account, when you’ve gained enough experience and require advanced features like tighter spreads, faster execution, and a fixed commission structure. Upgrading is beneficial when you’re trading larger volumes or need specific conditions that support high-frequency and precise trading strategies.

How to Open Multiple Exness Accounts?

To open multiple Exness accounts, log in to your Personal Area and select the option to create a new account. You can choose a different account type, adjust settings (such as leverage), and set your preferred base currency. Exness allows you to manage multiple accounts under one profile, making it easy to apply different strategies or use various account types for diversified trading.